Participant Enquiries

NDIS Compliant Invoice and Invoicing Guide for Providers

Take the stress out of NDIS invoicing and get paid faster with Empowrd’s professional tools.

Invoicing NDIS Participants Through a Plan Manager

When an NDIS participant uses Empowrd for plan management, providers must send their invoices directly to us for processing.

One of the key benefits of plan management is that Empowrd reviews invoices daily to help ensure payments are processed quickly. However, following recent changes to NDIS funding, Empowrd can no longer provide support to providers or support workers for preparing or correcting invoices.

This is because the NDIS has removed plan setup fees and rural and remote loadings, which previously funded this complimentary support service.

What Empowrd Can Still Do For Participants

Empowrd will continue to support participants through plan management, including:

- Managing and monitoring budgets over the course of the plan

- Lodging NDIS claims and paying providers for delivered services

- Maintaining records and producing monthly statements showing the financial position of the plan

Important Changes Providers Need to Know

Providers should be aware of these critical updates:

- Invoices must be legible and typed. Handwritten invoices are no longer accepted.

- Invoices must include support item codes that relate to the services provided.

- Non-compliant invoices will be returned via a “do not reply” email. This email will outline what information is missing or incorrect. Providers will need to check their invoice, make necessary changes, and resubmit it for processing.

- Empowrd cannot amend invoices on behalf of providers. It is each provider’s responsibility to ensure invoices are compliant.

Where Providers Can Get Help

While Empowrd can no longer assist with preparing invoices, providers can still get help directly from the NDIS:

- Call the NDIS Provider Helpline on 1300 311 675 for support with invoicing and compliance.

Where Participants Can Get Help

Participants can contact the NDIA if they need help liaising with their providers about invoicing:

- Use NDIA WebChat

- Call the NDIA on 1800 800 110

Previously, plan managers often provided this assistance as a complimentary service, but under the new funding model, this support is now managed directly by the NDIA.

What to Include in Your NDIS Invoice To Get Paid Faster

To avoid delays or rejection, providers’ invoices must include:

- Provider’s business name

- Provider’s ABN (unless exempt under ATO rules)

- Participant’s name and NDIS number (if provided)

- Support item number listed in the NDIS Support Catalogue

- Description of service provided

- Amount and quantity claimed for each unit of support (e.g. $51.09 x 2 units)

- Dates the support was delivered

- Total invoice amount

- GST component, if applicable (most NDIS services are GST-free)

Incomplete invoices are one of the main reasons payments are delayed or rejected.

Make Invoicing Easier with Empowrd’s Professional Tools and Support

Creating compliant invoices doesn’t have to be complicated.

Empowrd offers tools and services designed to help NDIS providers:

- Produce professional, legible invoices

- Avoid common mistakes that lead to rejections

- Include all details required for compliance

- Save time and reduce stress

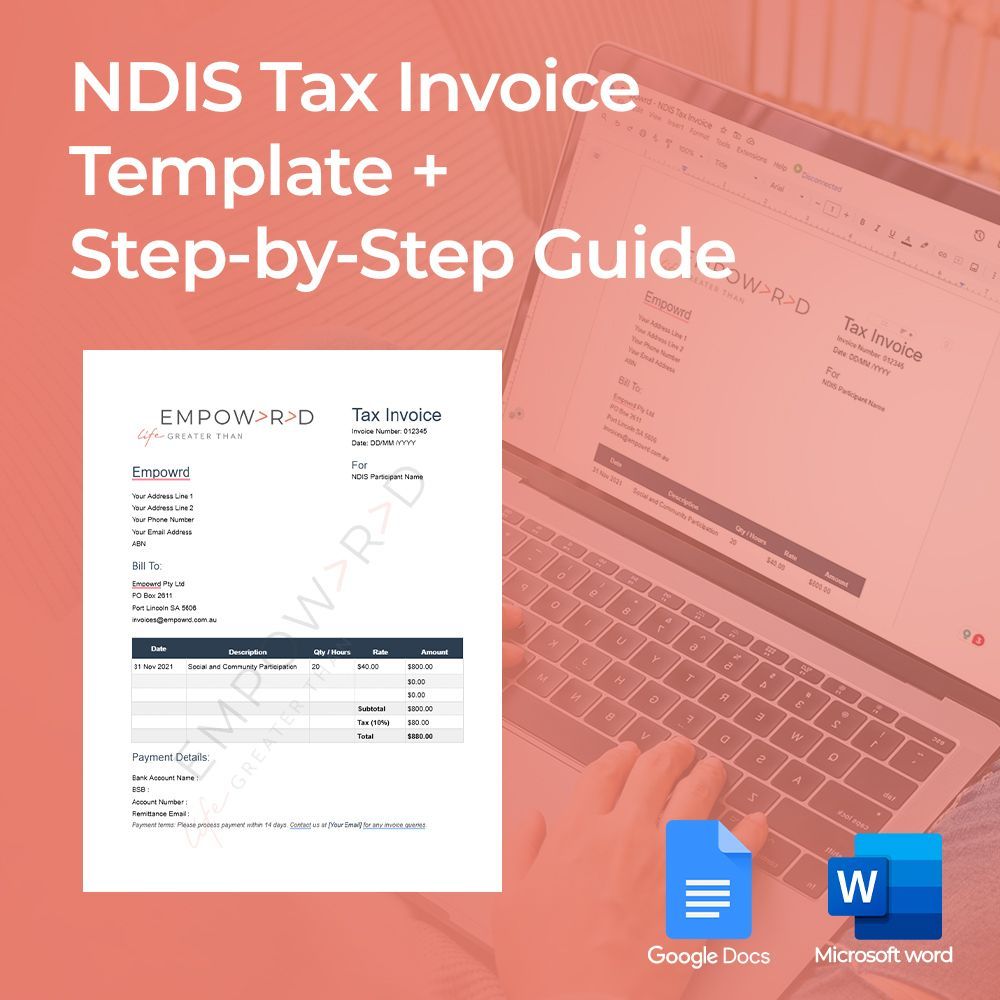

What’s Included in Our Paid Invoice Template Pack:

Editable NDIS Tax Invoice Template

- Step-by-step guide explaining each section

- Examples of correct invoice entries

- Tips to avoid the most common invoicing mistakes

Price:

$19.50

Or explore our full NDIS Independent Support Worker Success Toolkit for templates covering invoices, service agreements, quotes, and case notes — everything you need to simplify your business admin.

And if you’d like personalised help,

Empowrd also offers consulting services to support you with NDIS compliance, invoicing best practices, and running your business smoothly.

Providers Submitting an Invoice to Empowrd

Providers have two ways to submit invoices to Empowrd:

Option 1

Use Empowrd’s Online Invoice Builder

Save time and reduce errors by using our secure online invoice builder. Simply fill in all required fields, and your invoice will be automatically sent to our team for processing.

Option 2

Send Your Own Invoice by Email

Already have your own invoice prepared?

- Email it directly to: invoices@empowrd.com.au

- Please ensure your invoice meets all compliance requirements listed above.

- Non-compliant invoices will be returned for correction.

Note: Whether you submit online or via email, your invoice must be typed, legible, and include all necessary details. Empowrd cannot make corrections to invoices on your behalf.

NDIS Invoice FAQs

Empowering Participants Starts with EMPOWRD

At Empowrd, we believe every NDIS participant deserves the freedom to thrive — and NDIS providers like you help make that happen. While we can no longer assist with invoice preparation, our professional tools and templates are designed to help you stay compliant and get paid faster.

Have questions or need further information about plan management? Reach out today we’re ready when you are.